Why Thai Brokers Recommend PI for Service-Based Professions

In today’s service-driven economy, accountability is no longer optional—it’s expected. Service-based professionals in Thailand, from consultants to medical practitioners, fac

Specialist Insurance purpose built solutions for extraordinary situations.

Specialist Insurance is a broad term that typically refers to insurance policies that are designed to address specific, unique, or niche risks that may not be adequately covered by standard insurance products. These specialized policies are tailored to the distinctive needs of certain industries, professions, or activities, providing more targeted coverage for specific risks and exposures.

Event Insurance: Coverage for potential financial losses and liabilities associated with organizing and hosting events, such as conferences, weddings, concerts, or sports events.

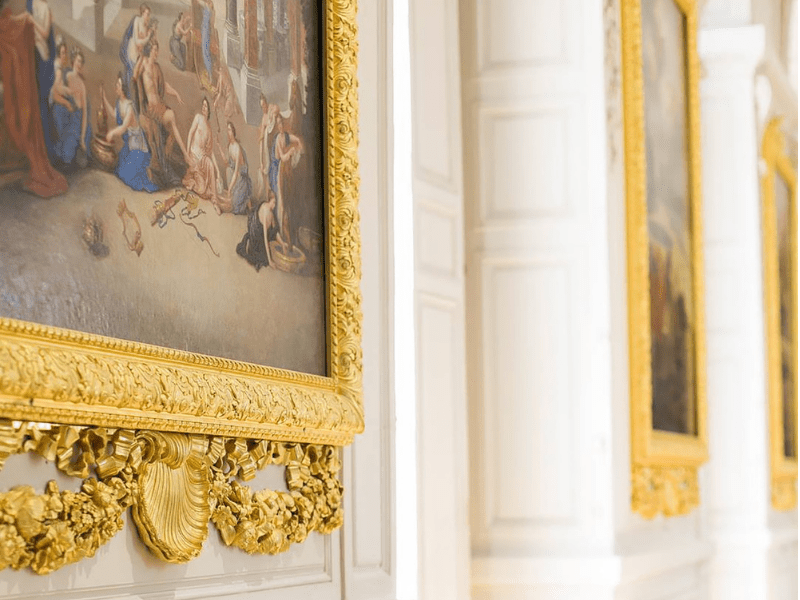

Fine Art Insurance: Insurance specifically designed to protect valuable works of art, collectibles, and antiques against damage, theft, or loss.

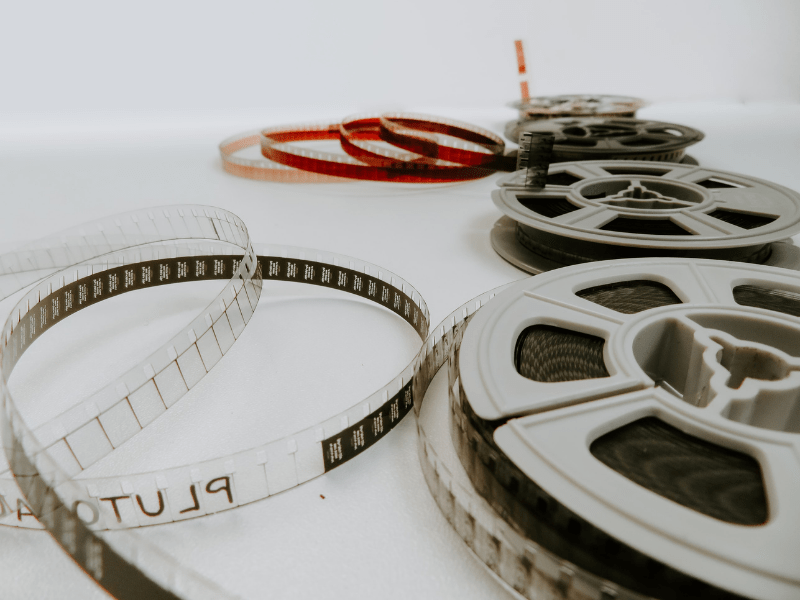

Film Production Insurance: Coverage for risks associated with film and television production, including equipment damage, liability, and other industry-specific risks.

Cyber Insurance: Protection against the financial losses and liabilities resulting from cyberattacks, data breaches, and other cyber-related risks.

Environmental Liability Insurance: Coverage for liabilities related to environmental pollution and contamination, addressing the costs of cleanup and legal responsibilities.

Kidnap & Ransom Insurance: Insurance designed to provide protection in the event of kidnapping, extortion, or related security threats, often sought by high-profile individuals and businesses operating in regions with security concerns.

Event Cancellation Insurance: Coverage for financial losses incurred due to the cancellation, postponement, or disruption of planned events, such as concerts, conferences, or weddings.

Political Risk Insurance: Protection against financial losses resulting from political events, such as government actions, expropriation, or currency inconvertibility, that may affect businesses operating in foreign countries.

Trade Credit Insurance: Coverage for businesses to protect against the risk of non-payment by customers due to insolvency or default.

Professional Indemnity Insurance: Coverage for professionals, such as consultants, architects, and lawyers, to protect against claims of negligence, errors, or omissions in the provision of their services.

The term “Specialist Insurance” can encompass a wide range of niche coverages, each designed to meet the unique needs and challenges of specific industries or activities. These policies often require a more nuanced understanding of the risks involved, and they may be tailored to the particular characteristics of the insured business or individual. Working with specialized insurance providers is common in this domain to ensure that coverage adequately addresses the specific exposures faced by the insured party.

Here are a few additional points to consider about specialist insurance:

Risk Assessment: Specialist insurers typically conduct thorough risk assessments to understand the unique challenges and exposures faced by the policyholder. This assessment helps in tailoring the insurance coverage to specific needs.

Cost of Premiums: Because specialist insurance is designed to cover specific and often high-risk situations, the premiums for these policies may be higher than those for standard insurance. The cost is often reflective of the increased level of risk and the specialized nature of the coverage.

Policy Exclusions: It’s crucial to carefully review the terms and conditions of any specialist insurance policy. Some policies may have specific exclusions or limitations that policyholders need to be aware of to ensure they have a clear understanding of what is covered and what is not.

Regulatory Compliance: Depending on the industry or type of risk being covered, there may be specific regulations and compliance requirements. Specialist insurers should be well-versed in these regulations and work with policyholders to ensure compliance.

Claims Handling: In the event of a claim, the process for handling claims can vary between specialist insurance providers. Understanding the claims process and how efficiently and effectively claims are handled is an important aspect of evaluating an insurance provider.

Market Dynamics: The specialist insurance market can be dynamic, with changes in risk profiles, regulations, and market conditions. Staying informed about developments in the industry can help policyholders make informed decisions about their coverage.

Broker Expertise: Insurance brokers who specialize in specific industries or types of coverage can be valuable partners in helping individuals and businesses find the right specialist insurance. They can navigate the complex landscape of specialized coverage and help clients make informed choices.

Emerging Risks: As new risks emerge, specialist insurance providers may develop innovative solutions to address these challenges. Keeping abreast of emerging risks and the insurance products available to mitigate them is essential for staying ahead in risk management.

Always consult with insurance professionals and carefully read and understand the terms and conditions of any insurance policy before purchasing. This ensures that the coverage meets your specific needs and provides the level of protection you require.

If you or your employees and their families travel for work or pleasure overseas, this policy will reimburse the expenses if a kidnapping for ransom happens.

Covers physical damage to the aircraft and legal liability arising out of its ownership and operation.

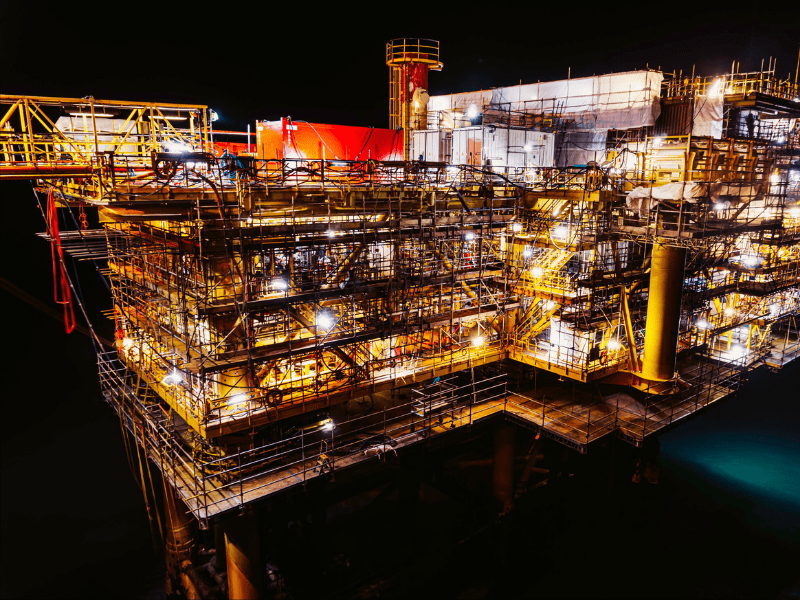

Navigate the challenges and opportunities related to oil and gas exploration and production.

Protects general contractors against lawsuits or claims arising from property damage and bodily injury that may occur on a construction job.

Coverage for damage to cargo while in their care, custody and control for purposes of import and export.

Cover for the physical loss or damage of moveable valuables, whether on display, in storage or in transit such as jewellery, fine art, precious metal and stones and other unique objects.

Covers damaged or destroyed property—including buildings, equipment, furnishings and inventory or business interruption due to terrorist & political activity.

Financial institutions insurance comprises a suite of insurance products developed for the financial industry.

Protection for a financial institution against losses from various criminal acts carried out by employees.

Complete coverage for multi-national organisations operating in multiple countries.

Cover on set injury and damage, specialised polices can usually be added on, according to your shoot.

Protection bondholders from default by the issuer by guaranteeing repayment of principal and interest accrued.

Guarantees to the obligee that the principal will fulfill an obligation or perform as required by the underlying contract.

Issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract

Insuring you against your buyer failing to pay under the credit terms agreed, due to commercial and political events beyond their control.

Covers the costs to have you evacuated for safety reasons such as natural disasters, political unrest, or medical emergency.

Reimbursement of irrecoverable costs and expenses incurred or loss of profit following the unforeseeable abandonment, postponement, interruption or cancellation of an event.

Secondary insurance to fill in coverage gaps. It covers unprecedented risks usually not covered, such as business interruption, postponed or delayed deliveries, or even cancelled events.

Insurance programmes tailored to the diverse and complex needs and requirements of those working in the sports, leisure & entertainment industries and allied services, for protection of assets and human capital.

A broad package policy tailored for risks of the jewellery industry’s manufacturers, retailers, exporters, security carriers, exhibitors and trade fairs.

Protection for your company against the environmental costs and damage associated directly from its operations.

We provide a responsive, personal service and would love to talk over coffee about your problem. We come to you so give us a call or tell us below how to get in touch with you:

Insurance policies to cover all aspects of life, health, business. Individually developed around the needs of each client, business entity, industry and environment. Working on your behalf to deliver best in class insurance cover from the leading insurance providers.

Click on a policy below to explore:

In today’s service-driven economy, accountability is no longer optional—it’s expected. Service-based professionals in Thailand, from consultants to medical practitioners, fac

Professional Indemnity (PI) Insurance is a must-have safety net for freelancers and consultants in Thailand. It protects professionals against claims of negligence, mistakes, or fa

In today’s professional landscape, mistakes, misunderstandings, and disputes are unavoidable. For engineers, architects, and accountants, a single oversight can lead to significa

Running a business in Thailand can be exciting, but it comes with unavoidable risks. Whether you’re operating a small café in Bangkok or managing a large manufacturing facility

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Thailand Insurance Service Ltd, © 2022 | All Rights Reserved