AI-Powered Cyber Threats: How Businesses in Thailand Can Stay Resilient

As artificial intelligence evolves, so do the threats facing today’s businesses. AI-powered threaths/attacks are increasingly targeting organizations, exploiting vulnerabil

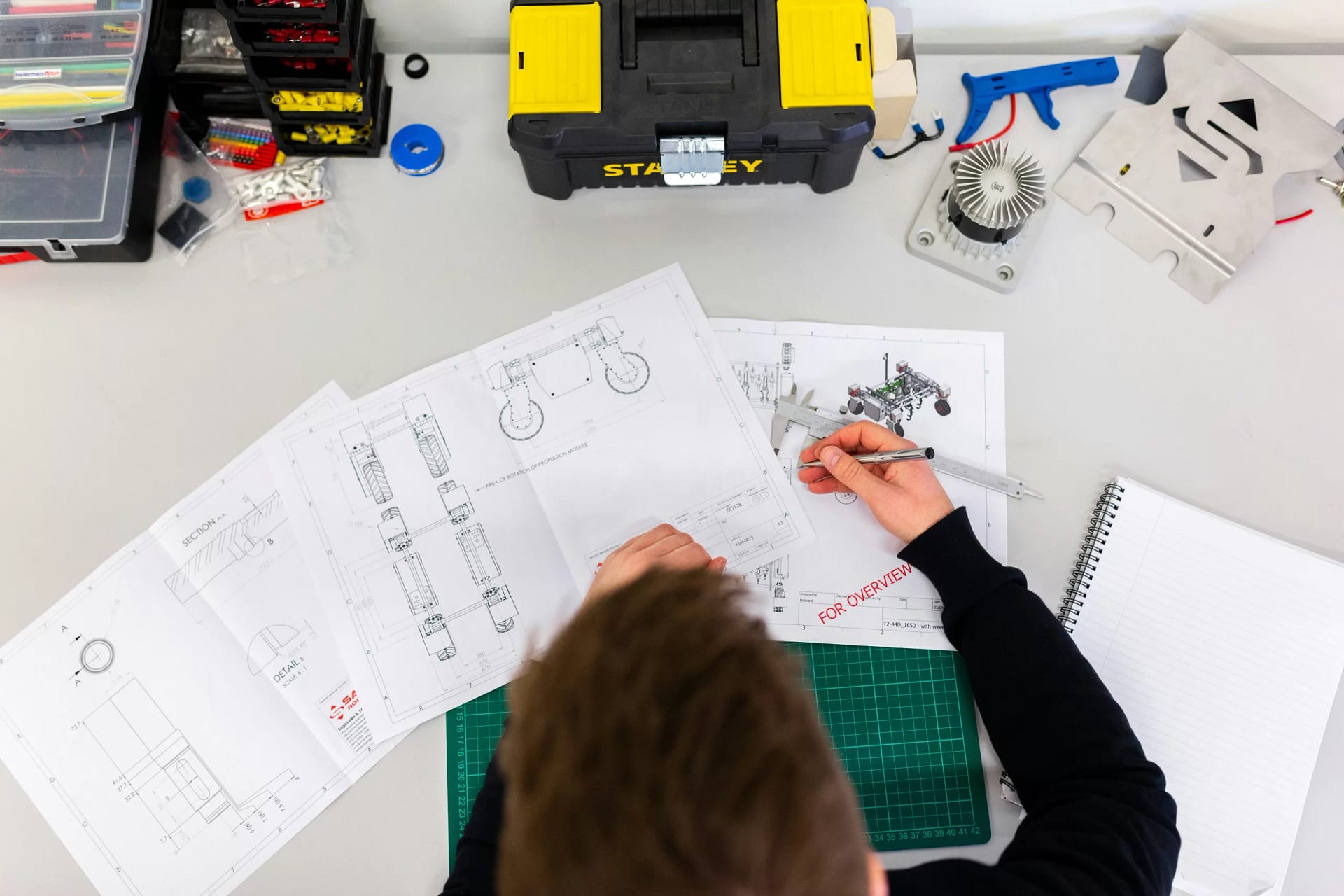

Engineering Insurance covers for all the electrical equipment and machinery used under a contract or job.

Engineering Insurance, also known as Engineering All Risk (EAR) Insurance, is a specialized type of insurance coverage designed to protect businesses and individuals involved in engineering projects against various risks. This type of insurance is tailored to the unique challenges and complexities of engineering endeavors, providing financial protection from the planning and design phase through construction and completion.

Material Damage Coverage: Protects against damage or loss to the physical property, equipment, and materials associated with engineering projects. This coverage includes perils such as fire, theft, vandalism, and natural disasters.

Third-Party Liability: Covers legal liabilities for bodily injury or property damage to third parties that may arise from the engineering activities. This can include injuries to workers, damage to neighboring properties, or other third-party claims.

Delay in Start-Up (DSU) or Advanced Loss of Profits (ALOP): Provides coverage for financial losses resulting from delays in the commencement of operations due to covered events. This can include additional construction costs, loss of income, and other related expenses.

Professional Indemnity: Offers protection against claims related to professional services provided during the engineering project, such as design, consultation, or project management.

Contractor’s Plant and Machinery (CPM): Extends coverage to construction equipment, machinery, and tools used in the engineering project against accidental damage or theft.

Erection All Risk (EAR): Similar to Construction All Risk (CAR) Insurance, EAR coverage protects against risks associated with the erection, installation, and commissioning of machinery, plants, or structures.

Electronics Equipment Insurance: Covers electronic equipment and systems against various risks, including breakdowns, malfunctions, or damage.

Professional Fees: Some policies may cover professional fees incurred due to the need to redesign or reconstruct parts of the engineering project following covered damage.

Engineering Insurance is crucial for managing the risks associated with engineering projects, which can range from infrastructure development and industrial facilities to technology installations. The policies are often highly customizable, allowing businesses to tailor coverage based on the specific needs and risks of their engineering endeavors.

As with any insurance, careful consideration of policy terms, customization based on project specifics, and collaboration with experienced insurance professionals are essential to ensuring that the coverage effectively addresses the unique risks associated with engineering projects.

When considering Engineering Insurance, here are additional factors to keep in mind to ensure comprehensive coverage and effective risk management:

Scope of Engineering Project: Clearly define the scope and nature of the engineering project. Different projects may involve varying degrees of complexity and risks, and understanding these specifics is crucial for tailoring insurance coverage.

Risk Assessment and Identification: Conduct a thorough risk assessment to identify potential perils and liabilities associated with the engineering project. This analysis should consider project location, size, duration, and other relevant factors.

Policy Limits and Deductibles: Understand the coverage limits provided by the policy and the deductible amounts. Adequate coverage limits and reasonable deductibles are essential for effective risk management.

Customization of Coverage: Work closely with insurance professionals to customize coverage based on the specific risks associated with the engineering project. Different projects may require different types and levels of coverage.

Contractual Requirements: Review project contracts and agreements to ensure that the insurance coverage aligns with contractual obligations. Some contracts may specify certain insurance requirements that need to be met.

Equipment and Machinery Inspection: Implement regular inspection and maintenance programs for construction equipment, machinery, and other critical components to minimize the risk of breakdowns or malfunctions.

Regulatory Compliance: Ensure that the Engineering Insurance policy complies with local regulations and legal requirements. Different jurisdictions may have specific insurance mandates for certain types of engineering projects.

Environmental Considerations: For projects with potential environmental impacts, ensure that the insurance policy includes coverage for environmental liabilities and cleanup costs.

Notification Procedures: Understand the notification procedures outlined in the insurance policy. Promptly report any incidents or circumstances that could lead to a claim to the insurance provider.

Review of Project Changes: Inform the insurance provider about any significant changes to the engineering project, such as alterations to the design, changes in the construction schedule, or modifications to the scope of work.

Training and Safety Protocols: Implement robust training programs and safety protocols to minimize the risk of accidents, injuries, and property damage during the engineering project.

Regular Policy Reviews: Periodically review and reassess the Engineering Insurance policy as the project progresses. Changes in project scope, schedules, or other factors may necessitate adjustments to the coverage.

By considering these additional factors, businesses and individuals involved in engineering projects can enhance the effectiveness of their Engineering Insurance coverage, ensuring that it aligns with the unique characteristics and risks associated with the specific project. Regular communication with insurance professionals and a proactive approach to risk management contribute to the overall success of engineering projects.

Contact our team of experts to help you find the right Engineering Insurance package for your company.

We provide a responsive, personal service and would love to talk over coffee about your problem. We come to you so give us a call or tell us below how to get in touch with you:

Insurance policies to cover all aspects of life, health, business. Individually developed around the needs of each client, business entity, industry and environment. Working on your behalf to deliver best in class insurance cover from the leading insurance providers.

Click on a policy below to explore:

As artificial intelligence evolves, so do the threats facing today’s businesses. AI-powered threaths/attacks are increasingly targeting organizations, exploiting vulnerabil

Operating small businesses in Thailand brings unique risks—from natural disasters to legal liabilities. Still, many small business owners underestimate the importance of insuranc

Renewing your business insurance isn’t just a routine task—it’s an opportunity to verify that your coverage accurately reflects your current and future risks. As your company

Business insurance in Thailand isn’t just about buying a policy — it’s about understanding how that coverage truly protects your operations. Unfortunately, many small busines

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Thailand Insurance Service Ltd, © 2022 | All Rights Reserved