Why Thai Brokers Recommend PI for Service-Based Professions

In today’s service-driven economy, accountability is no longer optional—it’s expected. Service-based professionals in Thailand, from consultants to medical practitioners, fac

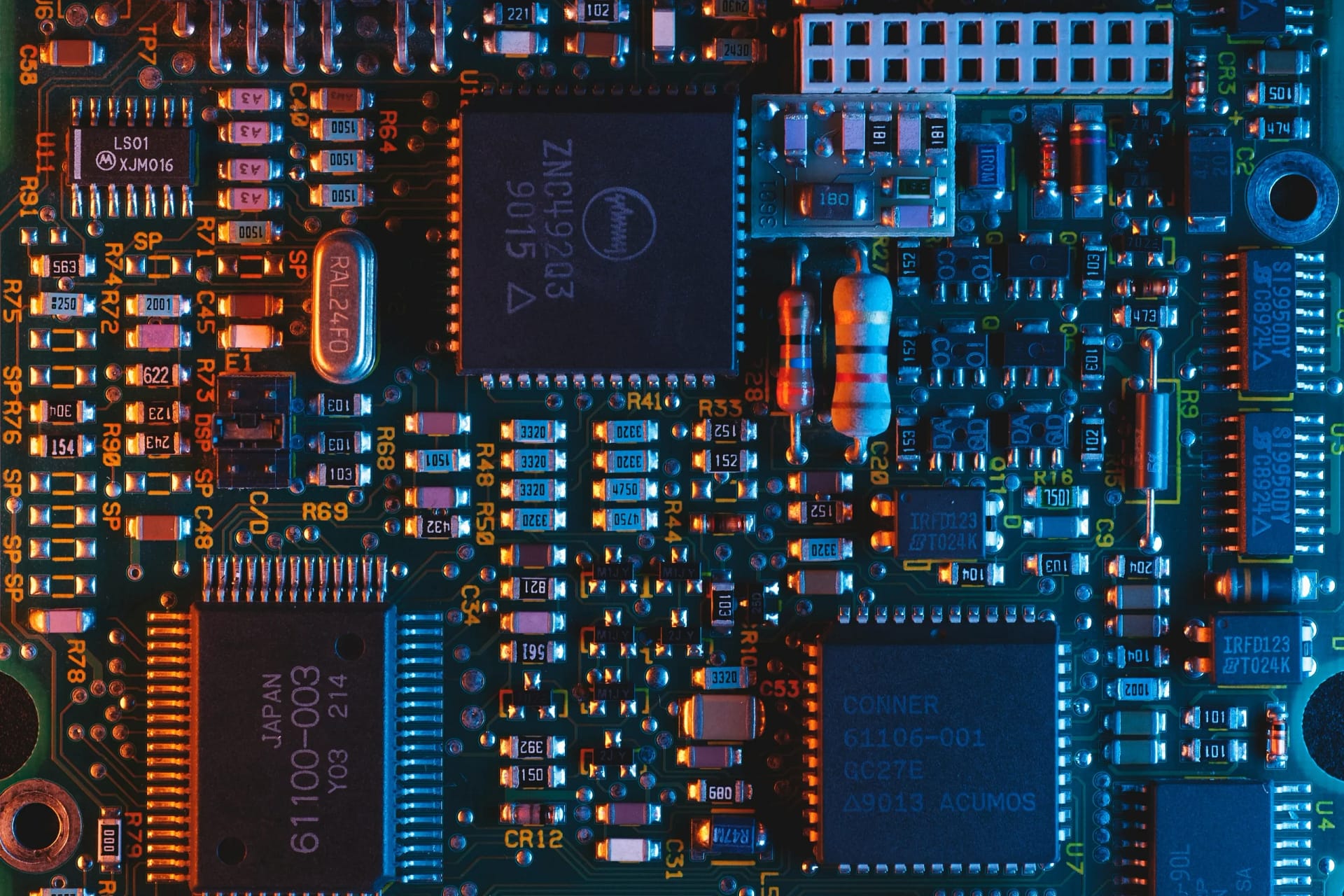

Electronic Equipment Insurance covers unforeseen physical damage to assets resulting from electronic, electrical or mechanical failure.

Electronic Equipment Insurance is a vital safeguard for businesses, covering against accidental, unforeseen, and sudden physical loss or damage to electronic equipment, including system software. This comprehensive coverage extends to protect against sudden and unforeseen physical damage caused by any peril or cause, as long as it is not expressly excluded under the policy terms. This means that whether the damage is due to events like fire, theft, power surges, or other unexpected incidents, your electronic equipment is covered.

For businesses establishing a presence in Thailand, this insurance is not just recommended; it is essential. The dynamic and unpredictable nature of business operations, coupled with the inherent risks to electronic equipment, makes Electronic Equipment Insurance a strategic investment. It provides the financial security necessary to repair or replace crucial technology infrastructure swiftly, ensuring minimal disruption and allowing your business to continue its operations seamlessly. In the fast-paced digital landscape, having this insurance is a proactive measure to mitigate potential setbacks and fortify the resilience of your business in the face of unforeseen challenges.

Fire and Explosion: Protection against damage caused by fires or explosions that may occur unexpectedly.

Theft: Coverage for electronic equipment that is stolen, providing financial support for replacement or recovery.

Power Surges: Protection against damage resulting from sudden and unexpected power surges or electrical overloads.

Natural Disasters: Coverage for damage caused by natural disasters such as earthquakes, floods, and storms.

Accidental Damage: Protection against accidental damage that occurs suddenly and unexpectedly.

Malicious Damage: Coverage for damage caused by intentional and malicious acts, such as vandalism.

Mechanical Breakdown: Protection against sudden and unforeseen mechanical failures of electronic equipment.

External Perils: Coverage for damage caused by external perils that are not expressly excluded in the policy.

It’s important to carefully review the specific terms and conditions of the Electronic Equipment Insurance policy, as coverage may vary among providers. Additionally, the policy may include exclusions or limitations that policyholders should be aware of to ensure they have a clear understanding of the extent of their coverage. Overall, Electronic Equipment Insurance is designed to offer comprehensive protection, allowing businesses to recover quickly from unexpected events that could otherwise disrupt their electronic infrastructure and operations.

When considering Electronic Equipment Insurance for your business, there are several additional factors to take into account to ensure comprehensive coverage and a well-informed decision:

Policy Exclusions: Carefully review the policy exclusions to understand what is not covered. Common exclusions may include pre-existing conditions, intentional acts, or certain types of perils.

Deductibles: Determine the deductible amount, which is the out-of-pocket expense the insured must pay before the insurance coverage kicks in. Consider how the deductible aligns with your budget and risk tolerance.

Policy Limits: Be aware of policy limits, which dictate the maximum amount the insurance company will pay for a covered loss. Ensure that the policy limits adequately match the value of your electronic equipment.

Risk Assessment: Conduct a thorough risk assessment of your business operations and electronic infrastructure. Identify specific risks and vulnerabilities to tailor the coverage to your unique needs.

Claims Process: Understand the claims process, including how to file a claim, the documentation required, and the expected timeframe for claim resolution. A smooth and efficient claims process is crucial during a crisis.

Coverage Adjustments: Regularly reassess your coverage as your business evolves. If you acquire new equipment, expand operations, or make significant changes to your technology infrastructure, adjust your coverage accordingly.

Cybersecurity Measures: While Electronic Equipment Insurance covers physical damage, it doesn’t typically address cybersecurity threats. Implement robust cybersecurity measures, such as firewalls, antivirus software, and employee training, to complement your insurance coverage.

Policy Renewal Terms: Understand the terms of policy renewal, including any changes in premiums, coverage, or policy conditions. Regularly review and update your insurance coverage to stay aligned with your business needs.

By considering these factors, businesses can make informed decisions when selecting Electronic Equipment Insurance and ensure that their coverage adequately addresses the unique risks and challenges associated with their electronic assets. Consulting with insurance professionals and risk management experts can provide valuable insights and guidance in this process.

Thailand Insurance Service has a team of experts who are able to give you the help and advice needed to secure the correct insurance for your business needs.

We provide a responsive, personal service and would love to talk over coffee about your problem. We come to you so give us a call or tell us below how to get in touch with you:

Insurance policies to cover all aspects of life, health, business. Individually developed around the needs of each client, business entity, industry and environment. Working on your behalf to deliver best in class insurance cover from the leading insurance providers.

Click on a policy below to explore:

In today’s service-driven economy, accountability is no longer optional—it’s expected. Service-based professionals in Thailand, from consultants to medical practitioners, fac

Professional Indemnity (PI) Insurance is a must-have safety net for freelancers and consultants in Thailand. It protects professionals against claims of negligence, mistakes, or fa

In today’s professional landscape, mistakes, misunderstandings, and disputes are unavoidable. For engineers, architects, and accountants, a single oversight can lead to significa

Running a business in Thailand can be exciting, but it comes with unavoidable risks. Whether you’re operating a small café in Bangkok or managing a large manufacturing facility

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Thailand Insurance Service Ltd, © 2022 | All Rights Reserved