Why Thai Brokers Recommend PI for Service-Based Professions

In today’s service-driven economy, accountability is no longer optional—it’s expected. Service-based professionals in Thailand, from consultants to medical practitioners, fac

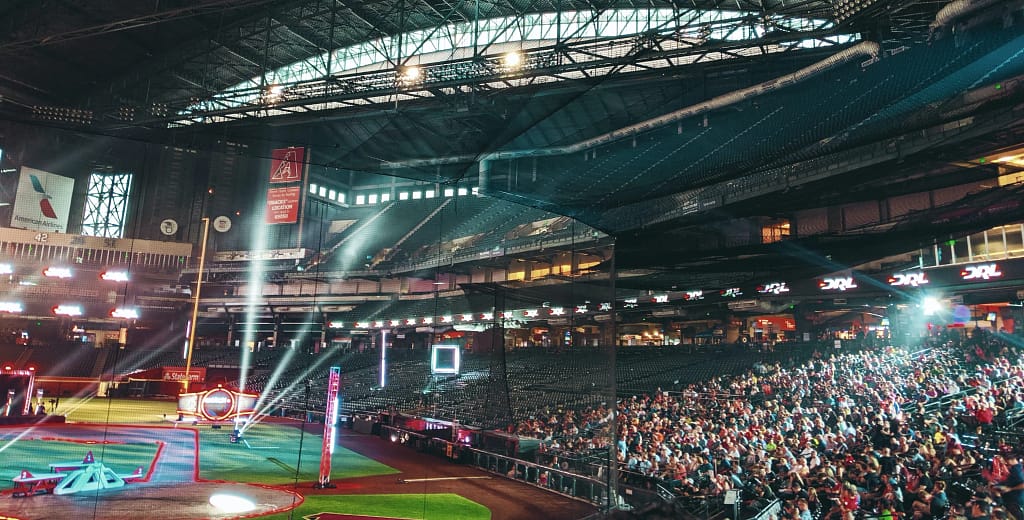

Sports, Leisure & Entertainment Insurance programmes tailored to the diverse and complex needs and requirements of those working in the sports, leisure & entertainment industries and allied services, for protection of assets and human capital.

Sports, Leisure & Entertainment Insurance is a specialized type of insurance coverage designed to protect businesses and individuals in the sports, leisure, and entertainment industries from various risks and liabilities. This type of insurance is tailored to the unique challenges and exposures faced by organizations and individuals involved in activities related to sports, recreation, leisure, and entertainment.

Liability Coverage: Protects against claims of bodily injury or property damage that may occur during sports, leisure, or entertainment events. This could include injuries to participants or spectators.

Event Cancellation Insurance: Provides coverage for financial losses incurred due to the cancellation, postponement, or disruption of planned events such as sports games, concerts, or festivals. This could include reimbursement for lost revenue and expenses.

Property Insurance: Covers physical assets such as stadiums, arenas, equipment, and facilities against risks like fire, vandalism, or natural disasters.

Participant Accident Insurance: Offers coverage for medical expenses and other costs in the event that a participant in a sports or recreational activity is injured.

Professional Liability (Errors and Omissions) Insurance: Protects individuals and organizations from claims related to professional negligence, errors, or omissions in the course of providing services. This is particularly relevant for professionals in the entertainment industry, such as agents, event organizers, and production companies.

Workers’ Compensation: Provides coverage for medical expenses and lost wages for employees who are injured while working in the sports, leisure, or entertainment industry.

Equipment Insurance: Covers damage, loss, or theft of specialized equipment used in sports, leisure, or entertainment activities.

Weather Insurance: Protects against financial losses resulting from adverse weather conditions that may impact outdoor events.

Media Liability Insurance: Offers protection against claims related to defamation, libel, or slander arising from media-related activities, such as broadcasting, publishing, or advertising.

Kidnap and Ransom Insurance: Provides coverage for expenses related to a kidnapping or extortion event involving key individuals in the sports, leisure, or entertainment industry.

Given the diverse nature of the sports, leisure, and entertainment sectors, insurance needs can vary widely. Therefore, organizations and individuals in these industries often work closely with insurance professionals to tailor coverage to their specific risks and requirements.

here are some additional considerations and aspects you should be aware of regarding Sports, Leisure & Entertainment Insurance:

Risk Assessment: It’s crucial to conduct a thorough risk assessment of your operations or event. Identifying potential risks and liabilities specific to your industry will help in determining the appropriate types and levels of insurance coverage needed.

Contractual Obligations: Many businesses in the sports, leisure, and entertainment industries work with contracts involving various parties such as sponsors, vendors, performers, and venue owners. Insurance requirements and indemnification clauses in these contracts should be carefully reviewed and complied with.

Policy Exclusions and Limitations: Like any insurance policy, Sports, Leisure & Entertainment Insurance policies come with exclusions and limitations. It’s essential to understand these to avoid surprises when making a claim. Working closely with an experienced insurance professional can help clarify these aspects.

Emergency Response Planning: Having an emergency response plan in place is crucial, especially for events with a large number of attendees. This plan should include procedures for dealing with medical emergencies, evacuations, and other unforeseen incidents.

Insurance for Emerging Risks: Keep in mind that the sports, leisure, and entertainment industries are dynamic, and new risks may emerge. Stay informed about emerging trends and technologies that may impact your operations, and assess whether your insurance coverage adequately addresses these evolving risks.

Cyber Insurance: In today’s digital age, the risk of cyber threats is significant. Consider obtaining cyber insurance to protect against data breaches, hacking, and other cyber-related risks, especially if your business relies on digital platforms for ticketing, promotions, or other activities.

International Coverage: If your activities or events extend beyond national borders, consider whether your insurance coverage provides protection on an international scale. International events may involve additional complexities and risks that need to be addressed in your insurance policy.

Claims Handling and Support: Understand the claims handling process of your insurance provider. Having a clear understanding of how to file a claim and the support available in the event of a claim is essential for a smooth resolution.

Remember, insurance needs can vary widely depending on the nature and scale of the sports, leisure, or entertainment business. It’s advisable to work closely with insurance professionals who specialize in this field to tailor coverage to your specific needs and help ensure comprehensive protection.

We provide a responsive, personal service and would love to talk over coffee about your problem. We come to you so give us a call or tell us below how to get in touch with you:

Insurance policies to cover all aspects of life, health, business. Individually developed around the needs of each client, business entity, industry and environment. Working on your behalf to deliver best in class insurance cover from the leading insurance providers.

Click on a policy below to explore:

In today’s service-driven economy, accountability is no longer optional—it’s expected. Service-based professionals in Thailand, from consultants to medical practitioners, fac

Professional Indemnity (PI) Insurance is a must-have safety net for freelancers and consultants in Thailand. It protects professionals against claims of negligence, mistakes, or fa

In today’s professional landscape, mistakes, misunderstandings, and disputes are unavoidable. For engineers, architects, and accountants, a single oversight can lead to significa

Running a business in Thailand can be exciting, but it comes with unavoidable risks. Whether you’re operating a small café in Bangkok or managing a large manufacturing facility

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Life & General insurance Services for Corporate, Commercial and Industrial clients.

Thailand Insurance Service Ltd, © 2022 | All Rights Reserved