Telehealth Group Insurance: A Key to Remote Work Success

Understanding Telehealth and Its Rise

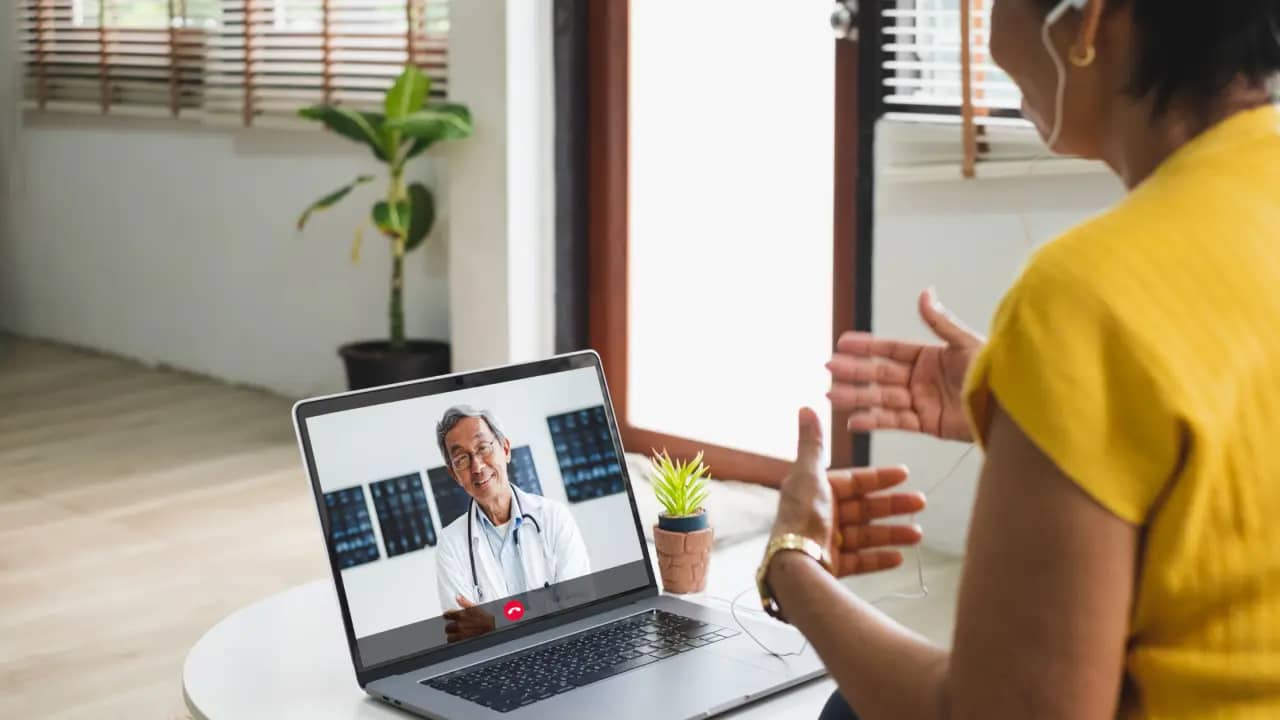

Telehealth has emerged as a beacon of innovation in healthcare, enabling patients to consult with healthcare providers remotely via digital platforms. This method of care is especially crucial in today’s context, where remote work has become more common than ever. Telehealth group insurance plans are now a must-have in employee benefits packages, offering a convenient, efficient, and effective way to access healthcare services.

The Importance of Group Insurance

Group insurance has always been a cornerstone of employee benefits, providing workers with health, dental, and vision coverage. In the era of remote work, however, the traditional model of healthcare delivery is undergoing a transformation. Group insurance now serves not just as a safety net but as a bridge connecting remote workers with the healthcare services they need, when they need them.

The Synergy of Telehealth and Group Insurance

Combining telehealth with group insurance creates a powerful synergy, offering remote workers unparalleled access to healthcare. This dynamic duo ensures that geographical barriers do not hinder employee health and well-being, making it a game-changer for businesses with distributed teams.

Benefits for Remote Workers

Telehealth group insurance offers myriad benefits for remote workers, from reduced travel time and costs to improved access to specialists and quicker appointment scheduling. This translates into healthier, happier employees who can maintain a better work-life balance.

Navigating the Challenges

Implementing group insurance comes with its set of challenges, including ensuring privacy, addressing technology gaps, and managing costs. However, with strategic planning and the right partnerships, these obstacles can be effectively navigated.

Implementation Tips for Employers

For employers looking to implement group insurance, it’s crucial to choose the right plan, educate employees about their options, and leverage technology to streamline the process. Regular feedback and adjustment will also ensure the program’s success.

Legal Considerations

Understanding the legal landscape, including privacy laws and telehealth regulations, is crucial for businesses offering telehealth group insurance.

Maximizing Utilization Among Remote Workers

Encouraging the adoption and regular use of telehealth services among remote workers can be achieved through education, incentives, and ongoing support.

Cost-Benefit Analysis for Businesses

While the upfront costs of offering telehealth group insurance may be a concern for some businesses, the long-term benefits, including reduced healthcare costs and increased employee productivity, often outweigh these initial investments. By providing remote workers with easy access to healthcare, businesses can reduce absenteeism and healthcare costs over time, while also attracting and retaining top talent by offering a competitive benefits package.

FAQs

What exactly is Telehealth Group Insurance?

Telehealth Group Insurance is a health insurance plan that includes telehealth services as part of its benefits package, allowing employees to consult healthcare professionals remotely through digital platforms.

How does Telehealth benefit remote workers specifically?

For remote workers, Telehealth offers convenience, flexibility, and immediate access to healthcare services without the need to travel, reducing downtime and ensuring they can receive care wherever they are located.

Can Telehealth Group Insurance replace traditional healthcare services?

While it doesn’t replace traditional in-person healthcare services for all scenarios, it serves as a complementary service that can handle many health concerns, reducing the need for physical office visits.

What should employers consider when choosing a Group Insurance plan?

Employers should evaluate the range of services covered, ease of use, technology requirements, provider networks, and how well the plan integrates with their existing health insurance offerings.